Company News: Green Street Adds Advanced Sales Comps to College House, Driving Greater Platform Value

GSN Roundup: Refi Bonanzas, Signature Loan Sales Approach $1B, and WPG Austin Unloads

Top stories in US CRE News this week:

Asset Backed Alert – 10.17.2025

Whole-Business Refi Bonanza Hits Market

The whole-business cashflow securitization sector is in the midst of a repricing surge.

After a sluggish first half, securitization sponsors since midyear have been lining up to take advantage of contracting spreads to issue new debt to refinance transactions issued from 2016 and 2019 that are nearing their anticipated repayment dates.

While issuers Domino’s, Dunkin’ Brands, Taco Bell and their peers have mostly addressed their bonds’ near-term maturities, sources see a potential for more refinancings, particularly if the Federal Reserve continues to lower interest rates.

Seven whole-business transactions totaling $5.4 billion have priced so far in the second half, according to Asset-Backed Alert’s ABS Database, with an eighth, a $357.5 million offering from Cajun Global, expected to price by today.

In comparison, just four whole-business deals totaling $1.6 billion priced in the first half, when funding costs rose amid concerns about the effects of President Donald Trump’s tariffs.

As spreads have returned to pre-Liberation Day levels, refinancing has become more attractive.

On Oct. 8, Dunkin’ priced $900 million of bonds in a transaction with two tranches rated BBB by S&P and KBRA. One, with an anticipated repayment date in November 2030, priced at a spread of 120 bp over the I-curve, while a tranche with an anticipated repayment date in November 2032 priced at 130 bp. Proceeds were slated to repay a tranche from a 2019 Dunkin’ deal that priced at 155 bp over swaps. That tranche had an anticipated maturity date next May.

If a deal’s outstanding tranches aren’t repaid by their expected maturity dates, it could enter rapid amortization, with any cash left over after paying interest on the notes diverted to repay note principal.

Similarly, on Sept. 16, Driven Brands priced a $500 million securitization with a single 4.9-year tranche at a spread of 175 bp over the I-curve. Proceeds were used to refinance a 2019 transaction paying 215 bp over swaps and a 2022 deal paying 350 bp over the I-curve.

On Sept. 9, Yum Brands priced a $1.5 billion securitization with a 4.8-year tranche that landed at 125 bp over the I-curve, and 6.7-year notes that printed at 130 bp. Proceeds were used, in part, to repay debt issued in a 2016 transaction.

And on Aug. 12, Domino’s priced a $1.0 billion deal with a 4.8-year class printing at 115 bp over the I-curve, and a 6.7-year tranche landing at 125 bp. Proceeds were used to repay debt issued in 2015 and 2018.

Not every transaction that hit the market in the second half is being used to refinance outstanding debt. On July 17, Jersey Mike’s priced a $400 million securitization with proceeds slated to fund general corporate purposes and dividend payments. The 6.8-year notes priced at 145 bp over the I-curve. They boosted total company leverage to 6.1x times securitized net cashflows from 5.7x, according to KBRA.

Cajun Global’s transaction is intended in part to refinance debt issued in 2019 and 2021 but also will boost overall leverage by increasing the total amount of debt outstanding.

Commercial Mortgage Alert 10.17.25

Next Signature Loan Sales To Approach $1B

A joint venture involving a Blackstone partnership and the FDIC is moving to sell nearly $1 billion of commercial mortgages originated by the failed Signature Bank.

The loans are split into a $557 million portfolio that the partnership is marketing via CBRE and a pool of roughly $430 million assigned to JLL. Sources said the offerings have similar profiles, consisting of small-balance, performing loans on properties in the New York metropolitan area.

Investors can bid on subportfolios. The marketing efforts launched this month, with bids due to JLL on Oct. 22 and to CBRE on Oct. 30.

Marketing materials for the loans listed with CBRE show an average balance of $4.2 million. There are 57 loans backed by retail properties, accounting for 47% of the pool’s principal balance at $260.0 million. Multifamily is the next-largest chunk with 52 loans totaling $200.4 million, or 36% of the total. There also are 18 office loans ($61.3 million, 11%) and six industrial loans ($34.9 million, 6%).

The collateral properties have a weighted average occupancy level of 92% and a debt yield of 10%. The mostly fixed-rate loans have a weighted average coupon of 4.0% and a weighted average maturity of 27 months, or 68 months when fully extended.

The portfolio out with JLL has an average balance of $3.9 million. Multifamily loans account for 47% of that pool by unpaid principal balance, with 54 loans totaling $202.8 million. There are 42 retail loans totaling $134.5 million, or 31% of the total, followed by 12 office loans ($83.9 million, 20%) and two industrial loans ($9.0 million, 2%).

The weighted average coupon on the JLL portfolio is 6.4%, and the loans carry a weighted average loan-to-value ratio of 58%. More than half the loans have a debt yield greater than 10%.

The two loan sales are at least the sixth and seventh offered by the Blackstone-led joint venture since it formed in December 2023 to take on a huge chunk of loans from Signature Bank, which had collapsed amid a run on deposits. The joint venture now has marketed roughly $3.8 billion of loans, at least, spanning performing and nonperforming debt. It’s unclear if all those loans found buyers.

Previous buyers of the loans have included Bayview Asset Management, Maverick Real Estate Partners and Morgan Stanley, which securitized its purchase. Word is that the performing loans have been selling at only a slight discount to par, mirroring trends across the loan-sale space.

The loans’ ownership took shape when Blackstone, Rialto Capital and CPP Investments teamed up to pay $1.2 billion for a 20% equity stake in a joint venture with the FDIC that held $16.8 billion of Signature mortgages. The portfolio represented most of the commercial real estate loans that were not acquired by Flagstar Bank when it took over Signature in March 2023.

The FDIC also had provided financing equal to 50% of the joint venture’s value, and sources said the parties have been using loan-sale proceeds to pay down that debt. Blackstone acts as the entity’s manager and oversees day-to-day operations.

Real Estate Alert 10.21.25

WPG Unloads Two Austin Shopping Centers

A partnership between Oxford Properties and Pine Tree has agreed to pay WPG $255 million for two Austin-area shopping centers.

The properties, the 421,000 sq ft Wolf Ranch Town Center and the 356,000 sq ft Lakeline Plaza & Village, each are 99% leased. Newmark marketed the centers for WPG, of Columbus, Ohio, which is winding down its operations.

The involvement of Oxford, the real estate investment arm of Toronto-based municipal-employee pension system Omers, is an example of the sector’s expanding buyer pool. The firm owns retail space at two locations in Manhattan, but no U.S. shopping centers.

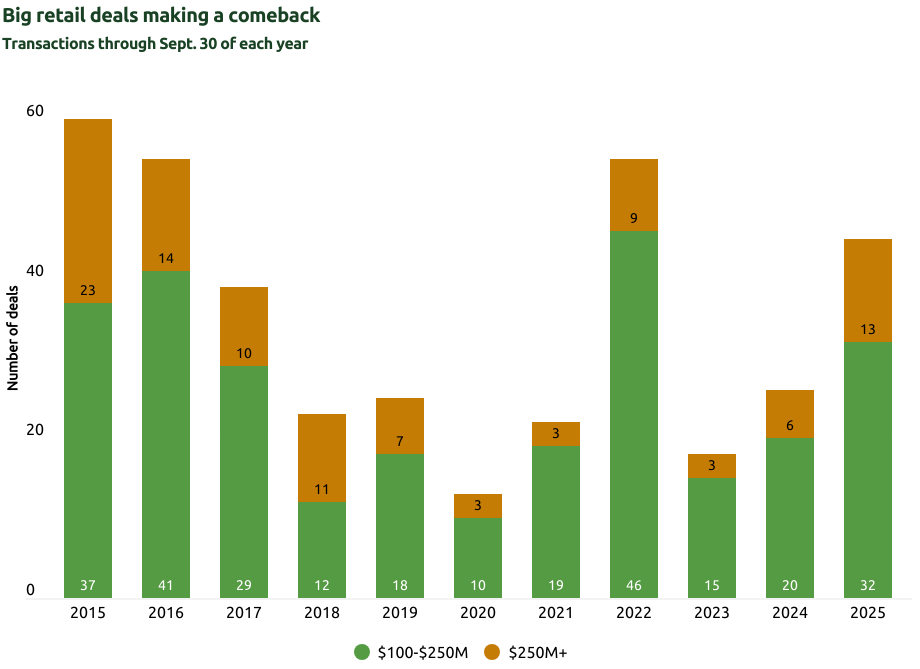

The deal could rank as the Austin retail market’s second-largest trade ever, according to Green Street’s Sales Comps Database. It also shows how investors are increasingly warming up to bigger deals in the sector. There were 13 U.S. retail trades of $250 million or more through September, more than double the amount during the same period last year. Deals of at least $100 million jumped 73% year-over-year, to 45 from 26.

The trend is continuing, as activity started with a bang in the fourth quarter. A partnership between New York-based DRA Advisors and DLC Management of Elmsford, N.Y., this month paid $599 million for nine West Coast shopping centers, and struck a deal to purchase a 10th property for $26 million before yearend. Eastdil Secured is advising the seller, Merlone Geier Partners of San Francisco.

Meanwhile, Asana Partners recently put a high-street retail portfolio in Boston’s tony Back Bay district up for grabs in a listing that could fetch $375 million to $410 million. That package totals 221,000 sq ft across 21 properties largely on Newbury Street. Newmark has the listing and is marketing it as either a full sale or recapitalization on behalf of Charlotte-based Asana and an unidentified partner.

WPG initially marketed the Austin-area centers as part of a larger 1.5 million sq ft portfolio, but was open to accepting bids on individual assets. The other properties are still on the block. They are the 366,000 sq ft Shops at North East Mall in the Dallas suburb of Hurst and the 354,000 sq ft Fairfield Town Center near Houston in Cypress.

Wolf Ranch Town Center is at 1015 West University Avenue in Georgetown. Tenants include Best Buy, Kohl’s, Michaels, Office Depot, PetSmart, Ross, Target and T.J.Maxx. Lakeline Plaza & Village is at 11066 Pecan Park Boulevard in Cedar Park. Tenants include Chili’s, Five Below, Fuddruckers, Old Navy, Party City, PetSmart and T.J.Maxx.

WPG also is shopping two other Austin shopping centers worth a combined $285 million. Eastdil is separately marketing those properties, the 478,000 sq ft Gateway Shopping Center, worth an estimated $175 million, and the 196,000 sq ft Arboretum, expected to fetch $110 million.

The largest retail trade ever in the Austin market came in 2019, when a 49% stake in a 1.2 million sq ft lifestyle center called Domain Northside sold for $293.4 million.

WPG, formerly known as Washington Prime Group, has been one of the year’s biggest retail property sellers, trading six high-end centers for nearly $1.2 billion year to date. The company also is marketing a three-property New Jersey portfolio.

Washington Prime filed for Chapter 11 bankruptcy protection in 2021 and was taken over by its leading creditor, activist hedge fund manager Strategic Value Partners. SVP rebranded the company to its current name after it emerged from bankruptcy later that year. WPG announced in April that it would sell all of its properties and would lay off all of its employees by early next year.