Company News: Green Street Releases 2026 Annual Sector Outlooks Delivering Critical Market Insights

GSN Roundup: Fiber Companies & ABS, CMBS Loan for Disney Hotel, and Blackstone Industrial Wager

Top stories in US CRE News this week:

Asset Backed Alert 02.06.26

More Fiber Companies Jump On ABS Train

Fiber-optic network operators Ezee Fiber and Surf Internet are laying the groundwork for their inaugural asset-backed bond offerings, as the asset class continues to grow at a record pace.

Meanwhile, Lightpath is marketing its debut bond offering. The $1.7 billion securitization could price by today.

In recent weeks, executives from Houston-based Ezee have discussed securitizing the company’s fiber-optic network receivables with potential bookrunners, though the timing of any transaction is not clear.

Ezee serves homeowners and businesses in New Mexico, Oregon, Texas and Washington. The company is in the midst of a $400 million expansion into the Midwest, and recently began offering its services in the Chicago area.

Surf, based in Elkhart, Ind., operates networks in Illinois, Indiana and Michigan. It is working to expand the footprint of its fiber-optic network to underserved and rural communities.

Surf’s securitization initiative is being spearheaded by chief financial officer Ryan Delack, who joined the company in 2022 following a stint in a similar role at environmental-monitoring company Dickson. Delack is expected to discuss the company’s plans with market professionals at the SFVegas 2026 conference from Feb. 22 to 25 at the Aria Resort & Casino in Las Vegas.

Surf last month received an equity investment led by Macquarie, and including Bain Capital and Future Standard, to help expand its network. The size of the investment wasn’t disclosed. That followed a $175 million equity investment a year ago by Macquarie, Bain and Post Road Group.

Proceeds from both companies’ asset-backed bond offerings will help finance their network buildouts.

Lightpath, of Bethpage, N.Y., operates networks in Boston, Columbus, Ohio, Connecticut, Miami, New Jersey, New York, Pennsylvania, Phoenix and Virginia, according to a KBRA presale report.

The market for new bonds backed by fiber-optic network receivables exploded last year, with several first-time issuers pricing deals. In 2025, U.S. issuers printed a record 17 securitizations totaling $12.3 billion, up from seven deals adding up to $4.3 billion in 2024, according to Asset-Backed Alert’s ABS Database.

One deal already has crossed the finish line this year. The $960.1 million transaction from Uniti priced on Jan. 15 via bookrunners Bank of America, Barclays, Citigroup, Deutsche Bank, Goldman Sachs, JPMorgan Chase, Morgan Stanley, RBC and TD Bank.

KBRA is forecasting a slight decline in new fiber-bond issuance this year. “Given the concentration of issuers in 2025 and their frequent market activity, these issuers are unlikely to access the market as often in 2026,” the company said in a report.

Commercial Mortgage Alert 02.06.26

Large CMBS Loan Eyed for Disney Hotel Buy

BDT & MSD Partners is close to locking down a $510 million CMBS loan from JPMorgan Chase on the Four Seasons Resort Orlando.

The mortgage would help finance the firm’s planned $750 million acquisition of the 444-room hotel, on the Walt Disney World Resort grounds in Lake Buena Vista. The floating-rate, interest-only debt has an initial two-year term, with three one-year extension options.

JPMorgan’s loan has not yet closed. The bank intends to package the debt into a single-borrower CMBS deal that’s expected to price next week (FS 2026-ORL).

The property’s appraised value is $798.7 million, which would peg the mortgage’s loan-to-value ratio at 63.9%. The expected debt yield would be 9.7%, based on underwritten net cashflow of about $49.5 million. The anticipated debt-service coverage ratio would be 1.63 to 1 at issuance, based on that same metric. The borrower has committed to purchase a 6.5% cap on the one-month SOFR benchmark, preventing the debt-service coverage ratio from going below 1.10 to 1.

The property encompasses 376 standard rooms that average 500 sq ft and 60 suites that average 878 sq ft. Eight oversize suites also are available, including one with 3,300 sq ft.

Four Seasons Resort Orlando additionally has 55,000 sq ft of indoor and outdoor meeting space, including a 14,000 sq ft ballroom. There are seven food and beverage outlets, highlighted by Capa, a Michelin-starred Spanish steakhouse.

BDT & MSD expects to spend nearly $64 million, or about $144,000/room, on modernization and upgrades to areas including guest rooms, amenities and dining areas. That’s on top of $39 million spent on such work since 2021.

The 284-acre campus has a 5-acre water park with a splash zone, a lazy river and a climbing area. Other amenities include a kids club, multiple athletic fields and a fitness center, a spa/wellness center of about 13,000 sq ft and an 18-hole golf course dubbed Tranquilo.

There are also three retail outlets, each operated by the Four Seasons: Wardrobe, Fable and a golf pro shop.

The hotel has a five-diamond rating from AAA. It is part of the broader Golden Oak residential community and is among just a few hotels in the Disney World interior not owned or controlled by Walt Disney Co. Still, it works with the company to offer guests early access to Disney parks, an on-site character breakfast and planning offices.

The hotel, at 10100 Dream Tree Boulevard, was built in 2014 by Silverstein Properties and Dune Real Estate Partners. BDT & MSD is in line to buy the property from Host Hotels & Resorts, which acquired it in 2021 from Silverstein and Dune for $610 million.

BDT & MSD formed in 2023 via the merger of merchant bank BDT & Co. and investment firm MSD Partners, founded by billionaire Michael Dell.

In 2006, Dell bought the leasehold interest in the Four Seasons Resort Hualalai and the Hualalai Golf Course in Hawaii for $285 million. Last year, presumably via BDT & MSD, a Dell-related venture bought the land underneath the resort for $400 million, according to Pacific Business News.

Bloomberg first reported that BDT & MSD had agreed to buy Four Seasons Resort Orlando, along with the Four Seasons Resort and Residences Jackson Hole in Jackson Hole, Wyo. The report valued the latter property at about $250 million, below the $315 million Host paid for it in 2022.

Real Estate Alert 02.10.26

Blackstone Wagers Big on Industrial Demand

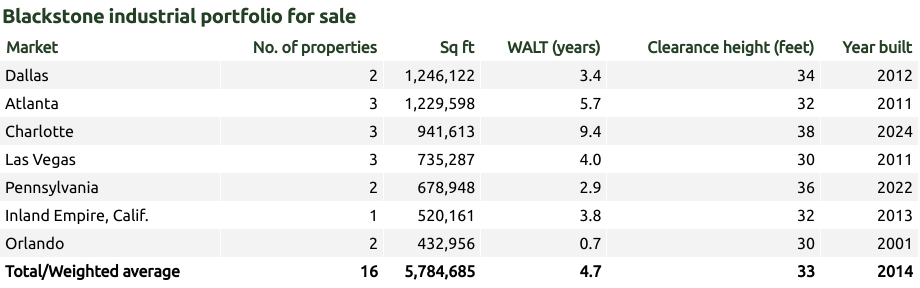

Blackstone is marketing a portfolio of 16 fully leased industrial properties worth about $1 billion, betting investor appetite for such large-scale transactions will rebound this year.

Working via its Link Logistics unit, the investment titan has engaged Eastdil Secured to market the 5.8 million sq ft package. The estimated value works out to $172/sq ft.

The Class-A properties are spread across seven markets. The Atlanta area accounts for the largest chunk of net operating income, at 19%, followed by California’s Inland Empire (17%), Pennsylvania (16%), Las Vegas (15%), Dallas (13%), Charlotte (13%) and Orlando (7%).

The marketing campaign is touting a blend of secure cashflow and the potential for rent growth. The portfolio has 25 tenants with a weighted average remaining lease term of 4.7 years and contractual rent bumps averaging 3.6%. No single tenant accounts for more than 17% of the rent roll, and the pitch is a new owner could raise rates upon rollover over the long term.

On average, the properties are 12 years old and have clearance heights of 33 feet. The largest chunk, accounting for 38% of the space, was completed in 2020 or later. The buildings’ sizes are diverse, with nearly a third at 100,000 to 250,000 sq ft.

At the start of last year, market participants were optimistic that massive industrial trades would come out of a slump and that several deals of $1 billion or more would take place. But President Donald Trump’s tariff plans put a chill on the leasing market, prompting investors to shy away from big bets and owners to pull large listings or break them up.

By yearend, no trades of $1 billion or more had closed.

The leasing outlook began to brighten late last year, however, and with a backdrop of debt-market resilience and pent-up demand, market pros anticipate big sales could stage a comeback this year.

Consider Brookfield’s Feb. 2 announcement that it had agreed to purchase industrial REIT Peakstone Realty Trust for $1.2 billion. Peakstone owns 76 industrial assets, including 60 industrial outdoor-storage properties. While the takeover would not count toward property-trading volume, market participants see it as evidence of an increasing willingness among major investors to chase large-scale acquisitions in the sector.

Link Logistics is the second-largest owner of U.S. industrial properties behind Prologis, with a 480 million sq ft portfolio, according to Green Street’s 2026 U.S. Industrial Outlook. And it remains an active buyer. In June, for example, it paid a venture between Pimco and Crow Holdings $718 million, or $131/sq ft, for a 5.8 million sq ft portfolio. Newmark brokered that deal.